In a recent article about the new Shift magazine, we wrote about the new publication’sobjective to discuss „the transition from car manufacturers to transport solutions providers”.

Readers wondered howis it possible for big car companies, known for the rhythm of mass production of all kinds of vehicles, to adapt to the apparently unpredictable pace of individual transport needs… Isn’t this the purpose of public transport? Of taxi? Or the younger relatives of the taxi, such as Uber, Lyft, Ola, Didi and the list goes on?…

In the past, the user had two options: acquisition or leasing. New forms of individual transport services transformed an entire generation of potential drivers – owners in rear-seat occupants, preoccupied with digital communication and using their smartphones, rather than navigating through the chaotic traffic in most of the big cities.

Another segment, trying to avoid the headaches of ownership (insurance, maintenance, parking) the car sharing solution has shown up, every car being used by a large number of clients.

The solution to pay only for as long as car services are needed and avoiding stress about everything related to car ownership has been attractive enough for 5.8 million users in 2015. This number grows rapidly and, according BCG’s (Boston Consulting Group) forecast will reach 35 million over the next three years.

The major impact of the new individual transport model are obvious and open the debate whether companies sell more?… or less cars?

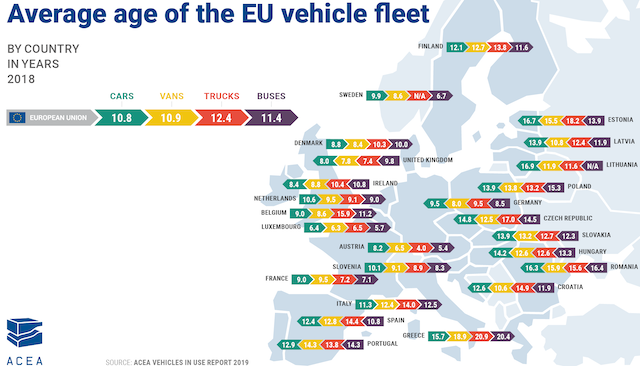

It seems obvious that when customers no longer buy cars, the number of individual sales drops. However, if every car is used 50% of the time, instead of 10% as it happens now, the annual mileage of each car will be much higher, requiring its replacement every 2 years instead of 10 years.

Another industrywith concerned thoughts about the new transportation model is the financial one. When customers will no longer buy cars, they will no longer pay interest on loans or leases. Some analysts believe that loans will be transferred from the individual to the companies that will manage car parks for car sharing.

As the recent example of the American Fair Company shows, companies with innovative business models for individual transport do not always need credit, with business financing being funded by investors who are interested in a different future of individual mobility.Fair has earned more than 1 billion funding, starting in 2016, for an interesting business model.

Fair makes the link between second hand carsinventory that are storedat dealers and customers interested in paying a minimum of $150 monthly fee for using these cars. Everything related to insurance, maintenance and technical assistance in case of malfunctions is provided by Fair. The customer can always return the car or replace it with another model with a five-day notice.

We have also written about Ford, Porsche, Volvo and Cadillac subscriptions, because despite the high monthly fee, this form of personal mobilityprovides the opportunity for customers to try out many models produced by these companies, without insurance any ong term comitments.

If we add GM Maven initiatives that will offer autonomous transport in 2019 or the merger of BMW and Mercedescar sharing companies in one entity it is easier to understand how much attention the big carmakers focus on new business models tailored to a generation that avoids to become the owner of an expensive item, that is losing value from the moment of leaving the dealer.

db